The development process of every economic corporation (EC) is influenced by the business environment and carries various risks, such as competition risks, legal risks, management risks, operational risks, and notably financial risks. When financial risks increase, they lead to financial risks for the ECs. This article focuses on analyzing issues related to financial risks and financial risk management within each EC, as well as methods to prevent financial risk exposure, aiming to enhance quality management practices.

Enterprise Risk Management (ERM) is a term used in business to describe the methods a company employs to identify and mitigate risks that could pose challenges to the business. Enterprise Risk Management is essential for both public and private companies to approach risk management confidently. An effective risk management approach, when integrated correctly, can significantly save costs for a company.

In 2004, a research group from JLA analyzed 76 companies in the S&P 500 regarding their types of risks, in which they experienced a 30% or higher decrease in market value. They found that 61% of occurrences were due to strategic risks, 30% were operational risks, and 9% were financial risks.

The board of directors selects one of the following five appropriate risk management strategies to address their identified risks:

Eliminating risks or activities that could have a negative impact on the organization’s assets. For example, canceling or temporarily suspending a production line or a proposed product.

Minimizing or limiting the severity of losses. For instance, the management can plan regular visits to their key suppliers to identify potential issues early on.

Exploring feasible alternatives to mitigate risks.

Actions that transfer risk to a third party, such as insurance agencies. For example, purchasing an insurance policy that can cover unexpected losses for the business.

Acknowledging identified risks and being prepared to face the consequences. Typically, any losses resulting from uninsurable or unavoidable risks fall under risk acceptance.

ERM follows a distinct and continuous process in which it proactively identifies and reassesses various strategic and key risks to ensure financial security for the business. This process includes five specific elements:

Risk Response: Evaluating various risk response strategies and selecting appropriate courses of action to mitigate the identified risks within the risk appetite of management.

Communication and Monitoring: Relevant information and data need to be continually monitored and communicated at all organizational levels.

Establishing Strategy/Objectives: Let’s consider Tesla, a publicly traded company operating in two main segments – automotive manufacturing and energy. In this example, the ERM process would begin by examining what drives the company’s value in the process of setting strategies/objectives. For Tesla, this could include the company’s competitive advantages, strategic innovations, core product lines, or acquisitions.

Enterprise Risk Management (ERM) for financial institutions pertains to the existing systems for identifying and managing all risks within a financial services company. This includes financial risks, operational risks, event risks, and strategic risks.

Financial institutions such as banks, insurance companies, and investment management firms are entrusted with managing the finances of the economy. Because financial institutions are of systemic importance to the economy, they are heavily regulated. The risks that these companies face can have broader economic implications, making it crucial for them to have well-developed enterprise risk management processes and systems.

Since the global financial crisis of 2008, which led to the collapse of major financial institutions like Bear Stearns and Lehman Brothers, the pressure both internally and externally to manage risks in the financial services industry has increased significantly.

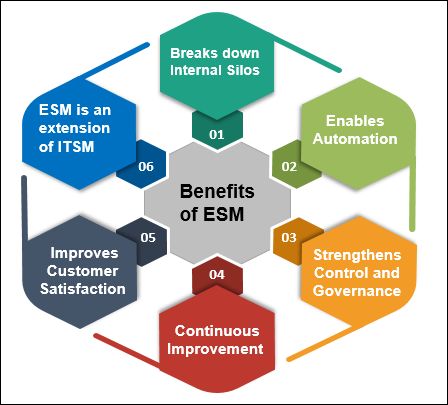

Enterprise Risk Management (ERM) can benefit financial organizations in several ways, including:

In addition to these four benefits, the implementation of an effective ERM program often brings about a cultural shift within the organization. Effective ERM programs typically allow financial organizations to take a longer-term view of risks and respond to them more proactively.

Managing enterprise risk for large and complex financial organizations is an extremely challenging endeavor that requires a significant number of specialized people and resources. Successful enterprise risk management systems are typically implemented using an ERM framework. The enterprise risk management framework consists of four key elements:

Hopefully, after reading this article, you will have a better understanding of what Financial Enterprise Risk Management is and the benefits it brings when implemented effectively.